Power BI for Finance

Cloubis helps businesses unleash the power of their data.

Tired of wasting hours on monthly financial reporting? Discover our Power BI solution for Finance for quick, automated and customized reports! With our innovative approach, generating reports becomes a breeze! Integrated into Excel, you maintain the familiar layout whilst having crucial reports available within one day after closing to make decisions and compare budgets.

Why

Regularly reviewing and analyzing your financial data, both on a daily basis and promptly after each monthly closing, is crucial to make quick and informed decisions. By doing so, you can identify emerging trends, pinpoint areas of concern, and capitalize on opportunities swiftly.

This proactive approach enables you to stay agile in a dynamic business environment, respond promptly to changing market conditions, and maintain a competitive edge. Moreover, it fosters a culture of data-driven decision-making throughout your organization, ensuring that key stakeholders are equipped with the insights they need to drive success.

By freeing up time for your financial controller(s) to conduct thorough analysis and delve into outliers, you can experience immediate benefits to your bottom line. This allows them to focus on identifying anomalies, uncovering hidden patterns, and extracting valuable insights from your financial data.

With more time dedicated to in-depth analysis, you can swiftly address discrepancies, optimize resource allocation, and make data-driven decisions that drive profitability. This proactive approach enhances your ability to identify and capitalize on revenue opportunities, mitigate risks, and improve overall financial performance. Ultimately, it empowers your organization to achieve greater efficiency, agility, and competitiveness in the marketplace.

The ability to compare multiple forecasting scenarios in a single view in Power BI offers a strategic advantage, enabling your team to swiftly adapt to dynamic market conditions. With this comprehensive perspective, you can quickly assess the potential impact of various scenarios on your business outcomes and make informed decisions accordingly. By evaluating different forecasts side by side, you gain valuable insights into the potential risks and opportunities inherent in each scenario.

This flexibility empowers you to proactively adjust your strategies, allocate resources efficiently, and capitalize on emerging trends or mitigate potential threats. Ultimately, it enhances your agility and resilience in navigating uncertainties, ensuring your organization remains competitive and responsive to evolving market dynamics.

Leveraging historical data to recalibrate forecasting can significantly enhance the precision of your planning efforts. By analyzing past trends, patterns, and performance metrics, you gain valuable insights into market behavior and business dynamics. This retrospective analysis allows you to identify key factors influencing past outcomes and anticipate their potential impact on future projections. Armed with this refined understanding, you can fine-tune your forecasting models, adjusting for changing market conditions, emerging trends, and other relevant variables.

As a result, your planning becomes more data-driven and adaptive, enabling you to make more accurate predictions and formulate strategies that are better aligned with actual market realities. Ultimately, this proactive approach strengthens your organization’s ability to anticipate challenges, seize opportunities, and optimize resource allocation for sustained growth and competitiveness.

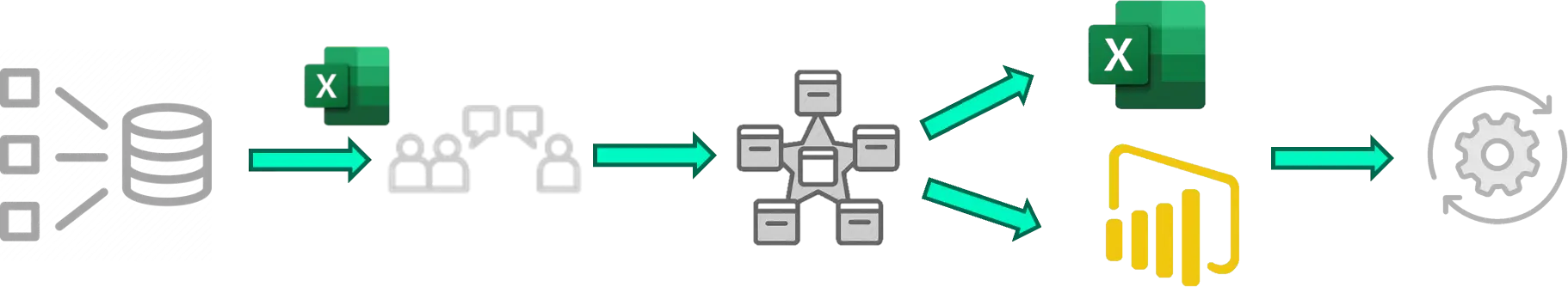

Employing an automated solution with Excel significantly reduces the learning curve for users. Excel’s widespread familiarity and user-friendly interface make it the ideal captain to navigate through the complexities of automation. With Excel steering the ship, users can leverage their existing knowledge and skills to quickly adapt to the new automated processes.

This seamless transition ensures minimal disruptions to workflows and facilitates swift adoption across teams. As a result, organizations can maximize the efficiency and effectiveness of their processes while minimizing the time and resources required for implementation.

During this 10-day journey* we implement your P&L in Power BI based on your company mapping structure.

Pricing and Key-Benefits

BI for Finance

Included in default-setup

Quick

Automated

In line with your accountancy

Tailored to your needs

Book a demo

Successful Cloubis collaborations

Frequently Asked Questions

Power BI for Finance is a tailored solution offered by Cloubis, designed to provide comprehensive insights into financial data using Microsoft’s Power BI platform. It enables finance professionals to visualize, analyze, and interpret financial data effectively, facilitating informed decision-making.

Using the combination of both Excel and Power BI it allows accountants, controllers and financial managers to leverage the flexibility of Excel whilst combining it with the advantages of Power BI.

Our solution makes it easy to setup and maintain a P&L in Power BI and allows you to easily switch between different accounting structures.

Power BI for Finance offers dynamic dashboards, reports, and visualizations that provide real-time insights into financial metrics such as revenue, expenses, profit margins, cash flow, budgeting, and forecasting. It integrates data from multiple sources, including accounting software, ERP systems, spreadsheets, and cloud services, enabling users to consolidate and analyze financial data easily.

It integrates seamlessly with accounting and ERP software like Exact Online, D365 F&O, D365 BC, Yuki, AFAS, Salesforce, SAP and others.

Companies should use Power BI for Finance for several reasons:

- Rapid Decision Making: Power BI enables companies to access and analyze financial data quickly, allowing for informed and timely decision-making. With real-time dashboards and interactive reports, stakeholders can gain insights into financial performance instantly.

- Free Up Time: By automating data collection, processing, and reporting tasks, Power BI frees up time for finance professionals to focus on analysis and strategic initiatives. This efficiency allows teams to be more productive and proactive in addressing business challenges.

- Compare Forecasting: Power BI provides the ability to compare multiple forecasting scenarios simultaneously, allowing finance teams to assess the potential impact of different assumptions or variables on financial projections. This feature enhances forecasting accuracy and supports better planning decisions.

- Improve Planning: With Power BI, companies can streamline the planning process by centralizing financial data and creating dynamic planning models. By leveraging historical information and predictive analytics, organizations can develop more accurate and actionable plans to achieve their financial goals.

- Excel Friendly: Power BI seamlessly integrates with Excel, allowing users to leverage familiar tools and workflows while benefiting from advanced analytics capabilities. This Excel-friendly approach makes it easier for finance professionals to adopt and utilize Power BI, minimizing training time and maximizing productivity.

Power BI for Finance streamlines financial reporting processes, enhances data visibility, and improves decision-making by providing actionable insights into financial performance. It empowers finance teams to identify trends, forecast future financial scenarios, and mitigate risks effectively.

Our solution makes it easy to setup and maintain a P&L in Power BI and allows you to easily switch between different accounting structures.

Still have questions about how Cloubis

can help your business with data?